There is a wide consensus among the financial community on what role crypto fits into the current financial system.

Others have retrofitted crypto into legacy rails while some are building from the ground up.

The industry has grown in the wild-wild-west for over a decade and a half and certain sectors have emerged to meet the standards of institutional investors. This brings legitimacy to the industry as a whole and serves as a boost for builders.

Many have suffered irreparable losses and others currently in jail just for writing code as the industry gains institutional adoption.

We are at the phase where people need to start paying attention. For valid reasons, people have stayed away from the asset class.

The question now becomes:

What is your excuse when managers of your retirement funds are allocating to this asset class with or without your permission?

Will you sit idly by and watch your savings be used to generate revenue that line the pockets of asset managers?

The purpose of this article is to let you know the Law Makers Globally are actually penning regulations that will protect all players in this space irrespective of demographics and geography.

Yes, the very people who condemned crypto are now its number one evangelists.

Regulatory Bodies across all continents have caught up to the need for the asset class to be adopted into mainstream finance, hence the following Frameworks are already in existence:

- USA – THE GENIUS AND CLARITY ACTS.

One thing the United States is known for is its innovation and ease of access to capital. The True American dream has always been founders willing to take risks that are being rewarded in the marketplace.

It is not by accident that the biggest companies are founded in the United states.

America innovates and the rest of the world scales.

One of the underlying tenets of the success of these companies is strong regulatory frameworks that enable and protect entrepreneurs and consumers respectively.

In the absence of regulatory clarity, people tend to build offshore as was the case with crypto 4 years ago. Perceived coordinated efforts by agencies to de-bank crypto founders, put them on notice or create opaque supervisory conditions dubbed operation Chokepoint 2.0.

With Trump declaring himself the Crypto President and campaigning to reverse all decisions by making America the Crypto Capital of the World brought a momentum never seen before in the Industry. Such as:

Cases being dropped, meetings between regulators and players of the industry, frameworks/guidance being provided pending clear regulations and Jail time being commuted.

A lot has been happening which might be confusing, but with good intentions as the Digital Financial Technology Report outlines policy recommendations to fulfil campaign promises of making America the Crypto Capital of the World.

Project Crypto seeks to modernize the laws and update financial systems to integrate both crypto and blockchain technology.

All these and others are just proposals that the next administration could reverse.

When it comes to thinking longterm and actually building wealth Onchain, The Guiding and Establishing National Innovation for U.S Stablecoins or the GENIUS ACT the first ever crypto law with bi-partisan support in the United States.

The bill provides a regulatory framework for dollar denominated Stablecoins that will be tethered mostly to the U.S reserves. This is a win for the dollar as stablecoins have grown astronomically in 2025 thereby democratizing the dollar globally. Things like

Reserve requirements from issuers, Transparency and audit, Consumer protection etc. make up this bill.

Simply put: this bill is a Consumer Protection Bill. Here is a fact sheet of all the provisions.

The biggest of all will be the Crypto Legal Accountability, Registration, and Transparency for Investors Act or CLARITY Act also known as Market Structure Bill. This will empower both the SEC and the CFTC with frameworks to regulate market activities.

Delays due to the 43-day Government Shutdown and complexity of the Bill that seeks to provide a comprehensive regulatory framework for digital assets only made it passed the house in 2025.

As in investor considering Crypto in the US, know the following:

Stablecoins are recognised and legal under federal law.

Crypto Tax reporting systems are converging towards traditional market norms.

Bank participation barriers have been reduced via regulatory guidance.

Can regulated institutions custody, transact, issue, report, and lend against crypto assets in a way that is predictable and enforceable? The answer is increasingly “yes” under this current administration.

2. EUROPEAN UNION

Europe is known for stifling innovation through regulation or over-regulation but props for adopting one of crypto’s most recognised regulatory frameworks with a continental impact.

Source:blockchainX

MiCA – Markets in Crypto-Asset Regulations harmonises rules for crypto-asset issuance and crypto-asset services across a single market thereby replacing fragmented national approaches enabling firms to scale across Europe.

MiCA like Genius covers:

Frameworks for stablecoin-like tokens

Issuer disclosures and accountability

Crypto asset service providers and expectations

Consumer Protection

FSMA – Financial Services and Markets Act in the UK provides the regulatory basis to bring crypto and stablecoin payments into financial rails. One of the biggest beneficiaries of this is Revolut – a neobank enabling its 65 million users to swap stablecoins at zero cost.

The momentum seen from GENIUS is causing governments all over the world to reverse their stands as a U.S backed stablecoin is a threat to foreign national currencies.

The UK Treasury is devising clear rules to make the UK the global destination for crypto firms to innovate.

Sterling pegged stablecoin is also a priority for the UK regulators moving forward.

3. ASIA

Asia, unlike the EU, does not have a single regulatory body that covers the entire continent.

What you see are dominant hub jurisdictions like Japan, Singapore, Hong Kong, UAE etc whose licensing and regulatory framework becomes a compliance baseline for major crypto service providers.

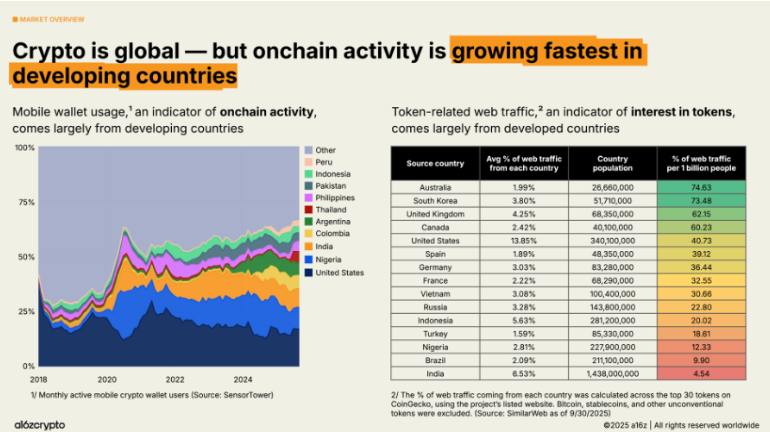

Asia alone is home to 60% of crypto’s global users demonstrated by onchain activities.

a. UAE –VARA

UAE is home to the biggest crypto names like Binance and Telegram as their framework supports licensing/supervision and attracts regional and cross border activities. No change in leadership is a plus as builders are certain of the continuity of the regulations in the environment they operate in.

b. Japan – PSA+FIEA

The Payment Services Act establishes the stablecoin framework while certain investment-related tokens are regulated by the Financial Instruments and Exchange Act.

But this 2026 Japan is transitioning all activities from the PSA to FIEA citing stronger investor protection as the main driver.

Bybit, one of crypto top exchanges plans on exiting Japan amidst the regulatory pressure for licensing.

Places like Singapore, South Korea, Hong Kong all do have viable frameworks that make crypto service provision operate in a regulatory environment.

- AFRICA

Africa is equally lacking in a continental framework but vibrant with nation state laws to regulate crypto-related activities. The following have some structures that regulate these activities:

– Nigeria – ISA(Investment and Securities Act)

Nigeria is Africa’s largest economy and one of the continent’s biggest crypto markets. ISA 2025 explicitly places virtual/digital asset exchanges and virtual asset service providers / digital asset operators into the SEC’s register-and-regulate perimeter.

Nigeria’s SEC has issued detailed rules on issuance/offering/custody of digital assets, providing concrete compliance obligations around offerings and custody-type activity.

-Kenya – Virtual Asset Service Providers Act, 2025

Kenya is a major East African fintech market; this Act is a clear, comprehensive licensing and regulation framework for VASPs “in and from Kenya,” which can become a regional reference model.

-South Africa – FAIS

Crypto was declared as a financial product under FAIS from 2022.

South Africa is home to one of Africa’s most developed financial regulatory environments; classifying crypto assets as a financial product pulls crypto intermediation into licensing/supervision expectations designed for investor protection.

Ghana officially ended years of regulatory uncertainty by passing and signing the VASP bill in December of 2025.

What should be noticeable is the absence of Francophone Africa. The Central African Republic declared Bitcoin as legal tender in April of 2022 while Central Banks prohibit financial institutions from interacting with cryptocurrencies.

Crypto is not outlawed but exists in a gray area in this region.

Source:BitcoinKids

South America is not to be left out as Argentina and Brazil see huge volumes of stablecoin activities.

Which is mirroring what we see in French Speaking Africa as locals tend to bitcoin and stablecoin to fight against inflation.

In conclusion, crypto is graduating into a macro asset and becoming increasingly investible as regulators seek to create a favourable environment that protects both the entrepreneurs and the investors.

Do your own research and consult a licensed professional before taking any action.

At CryptoStoic, we are explorers building wealth onchain one quarter at a time. If this interests you, you can check out the following: