Current Projects

WorldChain($WLD)

NB: Nothing here is financial advice or investment advice. Purely informational. To know when we deploy, Join our 10x Crypto x Stocks Strategy.

“The internet will inevitably need some kind of proof-of-humanity system in the near future”- World.

That future is here and NOW with software as a client.

Everything is changing whether you are conscious or not, basically how we live and go about our day to day: LLMs capable of doing Phd level research, business analysis and forecasts, AI agents executing tasks from start to completion being given just a goal, fron humanoids(human robots) to robotaxis, we keep getting matvelled.

Various aspects of our lives and businesses are completely being “AI’mated” especially mundane tasks. If your work entails using a computer for repetitive tasks, then it is just a matter of time.

Amazon launched AI Factories as the AWS for AI infrastructure. Amazon has more than a decade of robotic experience and knows what scales. This is just a tip of the iceberg as AI x Robotics come full circle.

Data remains the lifeblood of every business and our personal lives making it hardly indistinguishable when we are competing with AI Agents, Bots and Robots.

The next phase of the internet is going to be crawling with agents making it practically impossible to distinguish between an agent and a human.

As AI advances rapidly, it’s clear that some kind of identity based system to authenticate that you are not only human, but unique is imperative.

The goal of the World Project: create a globally-inclusive identity, financial and social network owned by the majority of humanity.

If successful, will scale a solution that distinguishes humans from AI online while preserving privacy and democratising processes.

Its a shift from KYC(know your customer) to KYA(know your agents)

“Proof of human” refers to establishing that an individual is both human and unique. Once established, you can prove you are different without having to reveal your real-world-identity(implementation of zero-knowledge proof).

To focus on the coin($WLD) is missing the big picture of the entire ecosystem. Here are the product suites:

World ID – Orb – verify your humanity and uniqueness with privacy preserved(+1500 orbs)

World App(SupperApp) – This is the gateway to the entire ecosystem(identity, banking – Virtual Bank Account, Chats etc)

World Chain – blockchain purposely designed for real humans that allow developers to reach millions of real users with apps for everyday life.

WorldCoin – It’s the token that distributes value to every human within the world network.

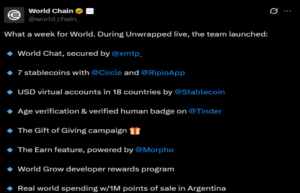

World Chat – a private messaging feature inside World App intended to be “bot-free” and paired with the ability to send payments in-chat. It’s positioned as a social layer that makes transacting feel like messaging.

Mini Apps – A marketplace of native-like apps that run inside World App and can leverage World ID + the wallet for onboarding and usage.

Recent Product Updates

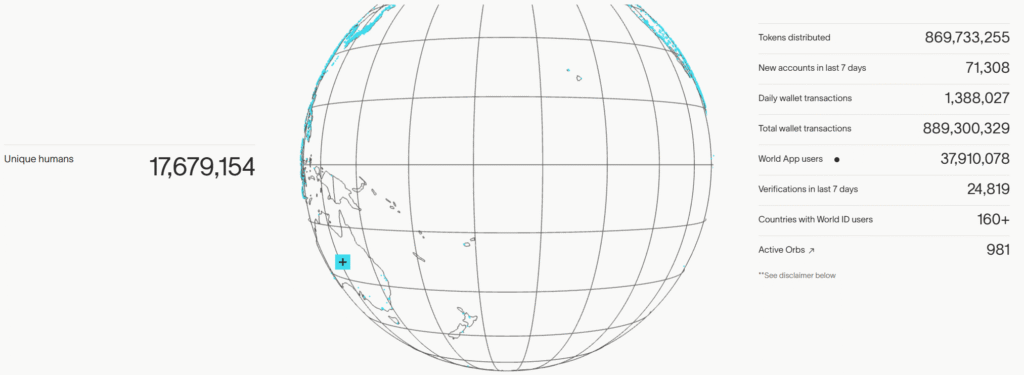

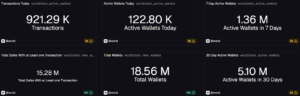

Ecosystem Metrics

Here is a live version of metrics from Dune

![]()

Live Active Addresses from Dune

Some useful metrics

12+ million people have completed orb verifications and obtained a World ID.

27+ million network accounts across 160+ countries.

Over 1,500 orbs deployed globally to scan iris and verify uniqueness.

23+ million world app users.

5.2+ million daily transactions.

If you remember MetCalfe’s law, this is a network effect(the more users you have on the network, the more valuable it becomes).

Most have not woken up to the fact that there is zero monetization as of now.

NB: Views expressed are purely those of the author and should not be considered as financial advice or investment advice. Purely informational. To know when we deploy, Join our 10x Crypto x Stocks Strategy.

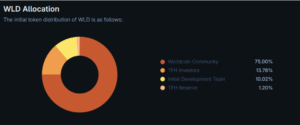

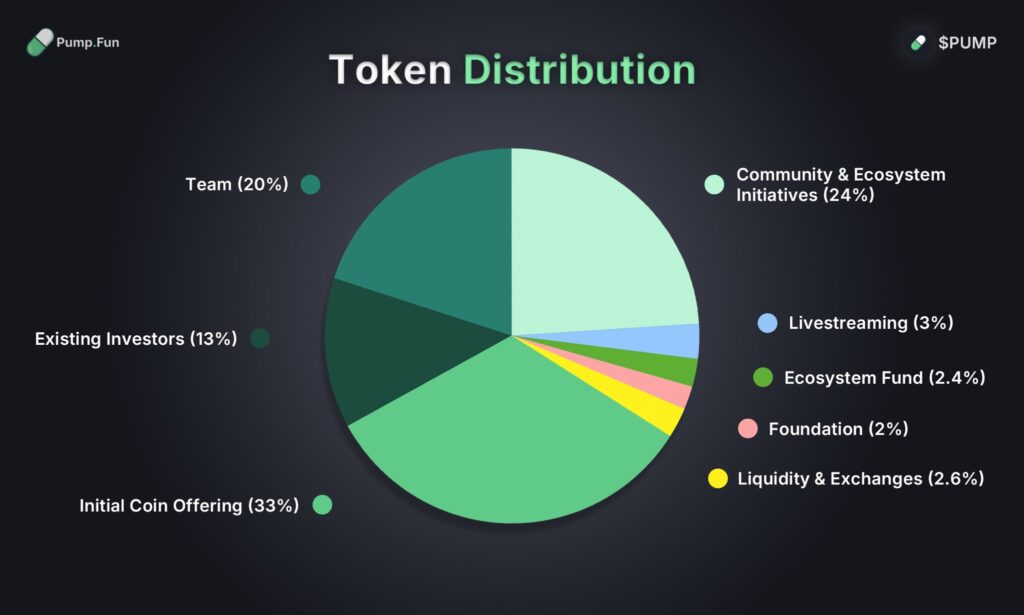

Tokenomics

Total supply = 10 billion

Circulating supply = 5.7 billion

Outstanding supply = 2.4 billion( actually tradable)

Via coingecko

75% of all WLD were allocated to the World Community with 25% to early investors .

The goal is to give 60% to users.

UNLOCK FULL ACCESS. GAIN AN EDGE TODAY

Vesting Schedule

Source: cryptorank.io

Daily unlocks by participant group

- TFH early contributors (Investors + Team)

- ≈ 2,000,000 WLD per day

- Community / user grants (Worldcoin Community pool)

- ≈ 977,429 WLD per day

What could go wrong?

Competition

SupperApp – From already established giants with distribution like Robinhood and Coinbase.

Identity – Privacy is becoming a huge concern together with Online Identity. There are other well funded projects like Humanity Protocol with a Mastercard partnership.

Regulation

We have concerns from some governments over the biometric data privacy with a call to delete all data of their citizens. Some include outright bans while others are ongoing investigations.

Many things could go wrong, but we are in the era of regulatory clarity.

Price is currently down -95% from previous All Time High

NB:Nothing here is financial advice or investment advice. Purely informational.

To know when we deploy, Join our 10x Crypto x Stocks Strategy.

Aave($Aave)

NB: Nothing here is financial advice or investment advice. Purely informational. To know when we deploy, Join our 10x Crypto x Stocks Strategy.

The global economy runs on credit sitting on a base layer of deep liquidity with trust, compliance and operational capabilities as non-negotiables.

We are in the early innings of rebuilding or revolutionalizing our core financial infrastructure and that can happen through what I describe as the BAP Model – Build, Acquire or Partner.

Various players are coming together, combining resources to bring this to reality. In crypto land, Decentralized Finance(DeFi) – is the building of financial services that are self executing, with no intermediaries. Benefits include:

- Financial Autonomy and Full Asset Control

- Significantly Lower Costs and Higher Yields

- Permissionless Global Accessibility

All is not rosy as you have smart contract risks that can drain liquidity pools.

DeFi Protocols have been battle tested, and those that have been building for the global economy are now ready to onboard the next waves of users while abstracting all the DeFi complexities that crypto natives are accustomed to.

The crypto business that will succeed will be those that users do not recognise its crypto native but seamlessly fit into their day to day.

AAVE LABS the builder of Aave (Cryptos’s Money Market) stands the chance as the DeFi protocol with the most PMF and value accrual.

The largest, most trusted and most liquid lending protocol in the history of DeFi( Finance running on code) on a mission to:

Bring the next trillion in assets to Aave

Unboard several millions

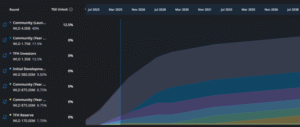

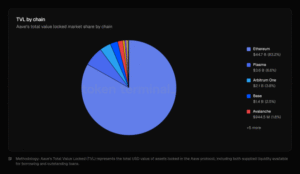

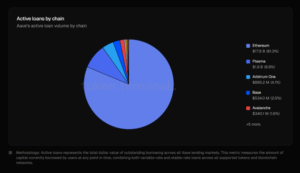

Here are some key financial metrics of Aave’s Lending activities.

2025 stats

Deployed over +19 chains

$963 billions in Loans Generated

$3.33T in Cumulative Deposits

$75 billion in deposits

Only protocol with $1 billion TVL on 4 networks

Controls 59% of DeFi Lending Market

Covers 61% of all active DeFi loans.

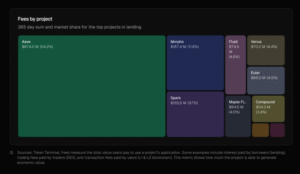

$885 million generated in fees(52% of all fees in lending protocols)

Use this link for full Protocol Metric Breakdown

In just 5 years its competing among in the top 50 banks in the U.S with $55.480 billion AUM

NB: Nothing here is financial advice or investment advice. Purely informational. To know when we deploy, Join our 10x Crypto x Stocks Strategy.

Catalysts for the Path Forward

Aave v4

Liquidity fragmentation is a critical issue projects face especially when deployed across multiple chains(+19 chains for Aave)

This update is targeted at unifying liquidity so Aave could handle trillions in assets. Benefits of deep liquidity:

- Price Stability and Reduced Market Impact

- Lower Transaction Costs and Tighter Spreads

- Efficient Price Discovery and Market Confidence

Horizon

Combining the best of DeFi and TradFi into a purpose-built infrastructure that meets both the compliance and operational needs of the largest financial institutions is the mission of horizon.

Bringing assets Onchain has received a green light from regulators and the DTTC is actively in a pilot program to tokenise US Treasuries on Canton Network.

Aave’s horizon will be plugging directly into TradFi Rails allowing it to pose tokenized assets as collateral as to access stablecoin liquidity.

Benefits of Tokenization

- Increased Liquidity and Fractional Ownership

- Greater Operational Efficiency and Faster Settlement

- Enhanced Transparency and Auditability

Top Institutional partners are in alignment as Aave plays a central role in bringing financial assets(equities, ETFs, real estate, mortgages, commodities bonds etc) Onchain.

Aave App

There is a proliferation of Neobanks without the infra to support banking activities.

But, Aave is a DeFiBank with deep liquidity to maximise on savings. It is designed to bring DeFi to everyone with the best cash-to-DeFi experience.

This is a DeFi mullet strategy at play – Fintech in the frontEnd with DeFi in the Backend.

Most crypto applications are far from reaching that status, but Aave App is indistinguishable from a regular day to day app. Every complexity has been abstracted to create a familiar user experience that does not require either behavior change or knowledge of blockchain technology.

Balance protection of up to $1M as opposed to industry standard of $250k using a multi-layered private protection model.

Earn up to 9% APY on your savings. Roll out is due early next year.

Join the waitlist.( The more people you onboard, the higher your potential APY).

Yet price does not reflect these fundamentals as it is -77% from its previous ATH.

To be fair, the mismatch between price and fundamentals is currently plaguing the entire crypto industry.

RISKS

Internal Civil war:

Aave Labs unilateral redirection of fees to private wallet without DAO involvement.

Between leadership and DAO about brand assets which are currently owned by Aave Labs.

The sentiment is reflected in the price as the asset is down -20%. Fear, uncertainty and doubt is not what you need as you go mainstream.

Competition:

Morpho and Kamino are viable competitors with growing distribution that can capture value from Aave.

Regulation

DeFi is still in the gray area with no path for institutions to own the native token except through vehicles like DAT(Digital Asset Treasuries).

All the banking services will require compliance and consumer protection which might not immediately onboard users.

NB: Views expressed are purely those of the author and should not be considered as financial advice or investment advice. Purely informational. To know when we deploy, Join our 10x Crypto x Stocks Strategy.

Pumpf.fun($PUMP)

NB: Nothing here is financial advice or investment advice. Purely informational. To know when we deploy, Join our 10x Crypto x Stocks Strategy.

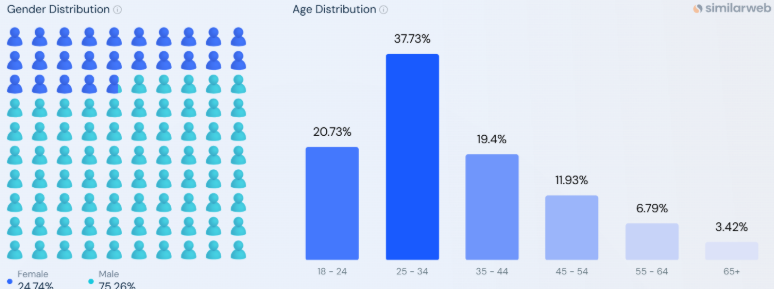

The zeitgeist of the time is attention and the dopamine rush of instant gratification. No one in crypto does it best like the team at pupm.fun. Not only do they attract, but retain attention.

Competitors struggle because they are trying to build a product for a demographic they do not relate with. The builders of pump.fun are on a live mission to create a new economy for creators.

The attract-extract model of the likes of Youtube, Facebook etc coupled with algorithmic manipulations turn creators into contents to be monetized by these platforms.

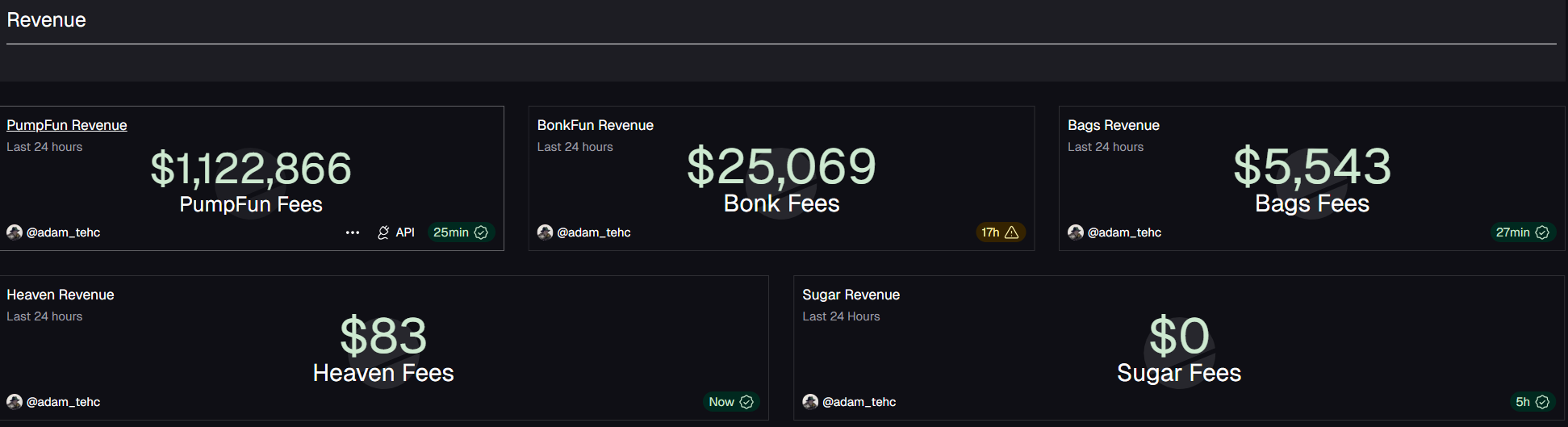

Pump.fun has stood out as one of the most successful products that has found PMF and generated most revenue, although currently 4th according to DeFiLlama data.

The mistake is to narrow it down to just another Memecoin Launchpad. Even at that it still trumps all other token launchpads in Revenue by a factor of 10x.

20% as Gen Z, 40% as millennials who are chronically online for +9hrs a day.

The best minds in the world are working on intermittent reinforcement techniques to keep us glued to devices. So pump.fun created that instant feedback loop for this demographic with services that keeps them locked in with a financial reward attached.

Think of TikTok, but with instant monetary gain.

Pump.fun thrives because it mirrors the digital and psychological realities of its users.

Initially it was the memecoin frenzy – anyone could now launch a token with zero coding skills. This was even before AI agents became popular. This completely disrupted the gated antiquated system that deprived devs with no liquidity.

Next was Live streaming – live streams sessions are tokenized and every streamer’s worth is directly tied to the audience they attract and retain. This was intended to take on giants like Twitch.

Since then it has iterated, launched a token after reaching more than $700M in revenue.

NB:To know when we deploy, Join our 10x Crypto x Stocks Strategy.

Nothing here is financial advice or investment advice. Purely informational.

Product Stack

Token launchpad,pumpswap,Streaming Service,Mobile APP,Pump chat

Acquisitions

Kolscan – Onchain wallet Tracker integrated into the platform that will boost social trading.

Padre – A multi-chain trading terminal that will strengthen its infrastructure and extend it beyond solana ecosystem.

You gotta ship fast to retain the users you have built as a year ago they tried to build a trading terminal.

The dopamine loop of action and instant feedback that leads to rewards is baked into the design of the platform. Content consumption, social engagement, and speculative feedback coupled with instant gratification perfectly fits into the narrative of its demographics.

Unlike the Attract-Extract Model, creator rewards are tied directly to the trading activity of their token generating fees that accrue to the creator.

The good thing here is your revenue is not dependent on follower’s count but on the trading activities of your coin.

The loneliness epidemic drove people online and some have never left. They create digital communities that enrich their lives.

For a generation that grew up online, this is the new entertainment loop, one that merges finance, friendship, and performance into a single feedback cycle – Messari

Catalysts

The team – young, dynamic and talented with the mission of creating the best possible environment for creators to thrive.

Daily Token buybacks averaging $1 million.

Creator fees sharing to boost trading activities instead of token creation

Just like Hyperliquid completely changed the Perp Dex landscape, Pump.fun has completely changed how memes are created and traded.

Token lockups – Both teams and investor tokens are locked until 2029, with 25% getting unlocked in July 2026.

Conclusion

Our biggest catalsyst is on the Team to continually re-invent both itself and the platform as they usher creators into a new revenue model.

The are building a userbase that they intend to grow with by delivering products or services that best meet their needs.

They will continue to capture market share and remain the undisputed masetro of the onchain attention economy.

To know when we deploy, Join our 10x Crypto x Stocks Strategy.

NB: Views expressed are purely those of the author and should not be considered as financial advice or investment advice. Purely informational. To know when we deploy, Join our 10x Crypto x Stocks Strategy.