How TradFi Took Crypto Mainstream.

There is a saying; how you do anything is how you do everything. As humans, we are creatures of habits and if you spend time studying history certain phenomena should not come as a surprise.

For more than a decade, the world’s most famous investors lined up to dunk on Bitcoin and crypto.

- “Cryptocurrencies basically have no value and they don’t produce anything.”

- “I think it’s rat poison… more expensive rat poison.”

- “Avoid bitcoin like the plague… there is nothing to support bitcoin.”

- “It’s a fraud… worse than tulip bulbs… it won’t end well.”

- “Bitcoin is a bubble… very much speculative.”

- “Bitcoin is an index for money laundering.”

- “Cryptocurrencies are not a store of value but an economic bubble.”

- “My very humble assessment is that it is worth nothing.”

TradFi translation: Crypto is dumb, dangerous, and probably going to zero.

The consensus from big-name value guys and macro legends was overwhelmingly negative.

Fast foward to today, its the 8th largest asset by market capitalization.(at the time of writing)

Incentives drive actions especially when business models are threatened. We all have different relationships with money and have grown up in different eras. There is no one side fits all when it comes to valuation of assets and no universal risk framework to adopt.

We have no crystal ball to weed off the bad players before they go bust. Let the free market be the judge of that and determine valuations.

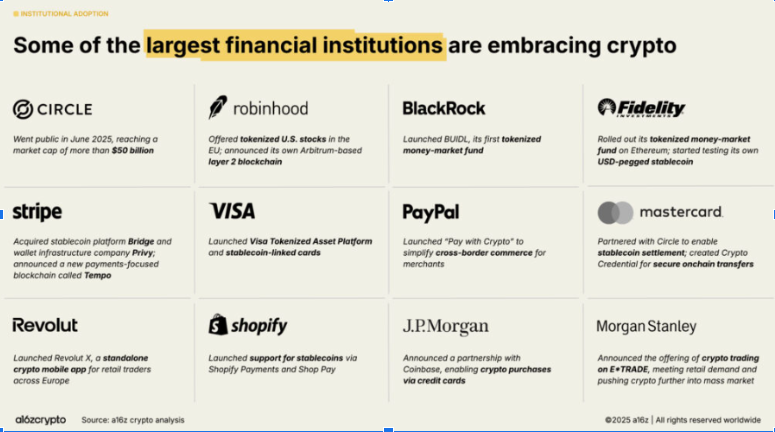

A decade and a half later and you have:

- Over $100B+ sitting in US spot Bitcoin ETFs alone.

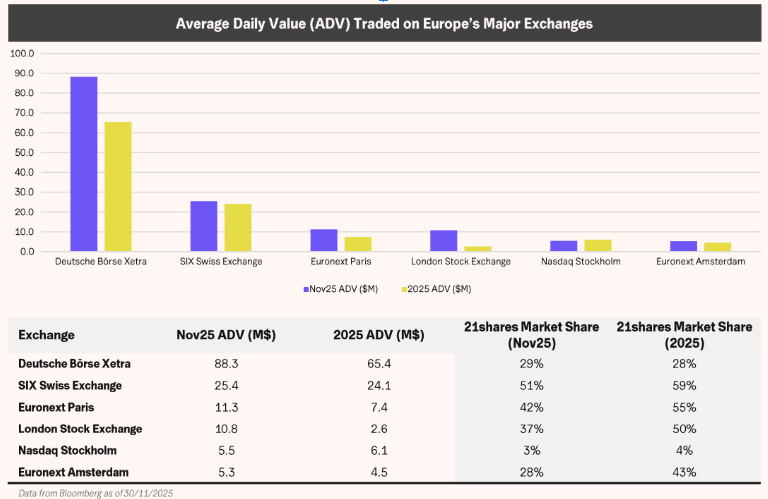

- Europe hosting $11.4B in physical crypto ETPs, with 21 Shares holding 35% market share.

- Digital Asset Treasuries (DATs) controlling $100B+ in crypto — around 4% of all BTC.

- Vanguard reversed its anti-crypto stance and opened its $11T platform and 50M+ clients to crypto ETFs.

- Bank of America and JPMorgan letting wealthy clients buy Bitcoin ETFs and ETPs through their advisors.

Crypto didn’t “go mainstream” because everyone started self-custodying assets.

It went mainstream because TradFi wrapped it in ETFs, ETPs and DATs and pushed it through the exact rails that once called it fraud, rat poison and a bubble.

Crypto moves fast while TradFi is a heavy machinery that communicates to each other at some level for reconciliation to be finalized.

This is not an indictment against TradFi. One thing you have to understand is these are institutions managing the livelihood of citizens hence the need for due-diligence.

Contrary to popular opinion, institutions move fast when all the “boxes” are checked. From the outside, we are not aware of the contents that make up the boxes.Ideally, it usually takes a decade for an asset to come under Tradfi radar. And, when it does, it’s a tsunami effect that takes the shape of: building from scratch, Partnering(M&A) or Buying.

Large financial institutions are now crypto’s distribution layer with infra to integrate crypto into services for everyday use.

The Three Big Wrappers: ETPs, ETFs, DATs

To understand how crypto went mainstream without everyone becoming onchain-native, you need to understand the three big TradFi wrappers.

1.1 Crypto ETPs – Europe’s First On-Ramp

Europe generally is known for regulating innovations rather than creating a conducive environment for experimentation and room for failure.

ETP (Exchange-Traded Product) is the broad bucket: exchange-traded vehicles whose price tracks an underlying asset — can be ETFs, ETNs, ETCs. In crypto, Europe led with physically backed ETPs.

- As of early 2025, European physical crypto ETPs held about $11.4B in assets, with 21Shares controlling 35% market share.

- Products like CoinShares Physical Bitcoin (BITC) have grown into Europe’s largest physical BTC ETPs, with CoinShares’ total AUM nearing $9B+.

With millions sitting in brokerage accounts, access to crypto simply means:

Buy a Bitcoin ETP on Xetra or SIX, in the same portfolio that holds Nestlé, LVMH and bond ETFs.

No new rails, no seed phrases, no MetaMask — just a ticker.

1.2 United States Spot Bitcoin ETFs – Wall Street’s Monster Hit

Unlike Europe, all the US needed was regulations from lawmakers as there was already demand from the clients of fund managers for exposure.

ETFs debuted in 1993, and have now become one of the safest and most efficient ways to gain exposure to the market overtaking mutual funds in AUM.

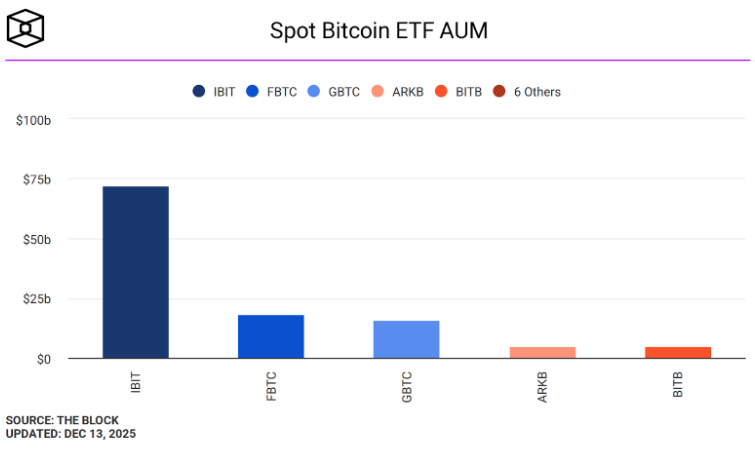

The US spot Bitcoin ETFs were the real unlock for US retail and advisors.

- By the end of their first year, US-listed spot BTC ETFs had $107B AUM, roughly 6% of Bitcoin’s market cap.

- Cumulative net inflows hit $40B+, pushing total ETF BTC holdings above $120B AUM in early 2025.

ETFs inflows were primarily responsible for driving bitcoin price from 50 – 100k, and the reason for the decoupling from the altcoin market.

- BlackRock’s iShares Bitcoin Trust (IBIT) crossed $70B AUM in just 341 trading days — the fastest ETF in history to hit that mark, and at its peak around $98–100B, it became BlackRock’s single biggest fee generator, earning ~$245M annually.

Even the old skeptics have pivoted around this:

- Larry Fink, who once called bitcoin an index of money laundering, now says he was wrong about Bitcoin and sees it as a hedge and portfolio asset, while BlackRock doubles down on crypto and tokenization of Real World Assets(RWA).

Meanwhile, TradFi has now become crypto’s distribution layer:

- Vanguard, historically anti-crypto, now lets its 50M+ brokerage customers trade regulated crypto ETFs and mutual funds, reversing years of opposition.

- Bank of America will allow advisors at Merrill and the Private Bank to recommend crypto ETPs as part of client portfolios starting 2026.

- JPMorgan now allows clients to buy Bitcoin and spot BTC ETFs and reflects those holdings in statements.

In practice, a huge slice of US exposure now looks like this:

401(k) → brokerage → ETF → Onchain BTC in institutional custody.

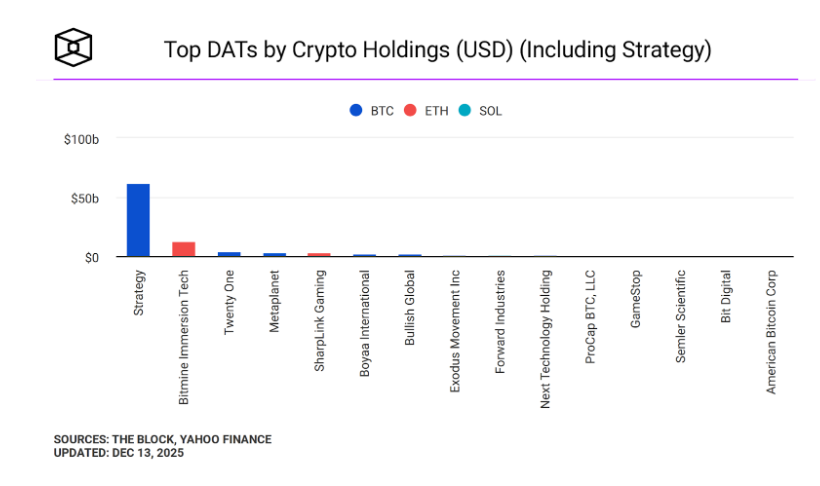

1.3 DATs – Digital Asset Treasuries as Crypto Proxies

DATs (Digital Asset Treasuries) are public companies whose core strategy is raising capital and using the balance sheet to hold crypto. This was pioneered by Michael Saylor in 2020.

- DATs collectively control $100B+ in digital assets, amounting to ~4% of all bitcoin by some estimates.

- Strategy (formerly MicroStrategy) alone now holds over $60.6B in BTC after a nearly $1B purchase in December 2025.

- BitMine Immersion Technologies, Inc. (BMNR) is a significant corporate holder of Ethereum (ETH) with the goal to treasury 5% of Ethereum supply. As of its most recent disclosures (December 2025), the company holds approximately 3.86 million ETH tokens valued at $12B.

DATs give stock-only investors a way to own crypto wrappers:

- The equity often trades at a premium or discount to NAV.

- Many issue equity or debt to buy more BTC, leveraging the exposure.

- They can be packaged into yet more ETFs (DAT baskets, miners + DATs baskets, etc.).

At a systems level, this means:

A growing chunk of the BTC float is now locked in corporate treasuries that trade on Nasdaq/NYSE rather than on a DEX.

Around 10% of all bitcoin now sits in TradFi wrappers: ETFs, ETPs, listed treasuries. That’s before counting miners, corporates, and banks holding BTC directly.

The same ecosystem that called Bitcoin: fraud, rat poison, index for money laundering…now earns hundreds of millions in fees and trading revenue tokenizing, packaging and distributing the same asset to the masses via old-school rails.

How That Took Crypto Mainstream

DATs then layer on levered demand: issuing stock, raising cash, buying more BTC, and tying their equity valuation directly to the asset’s scarcity.

What This Means Going Forward.

TradFi rebuilt the ownership structure of crypto using its own instruments.

- A double-digit percentage of BTC is now held via ETFs, ETPs, DATs, not directly by individuals.

- Access to crypto exposure is now default for tens of millions of brokerage and pension accounts.

- The biggest beneficiaries of this mainstreaming are the same institutions whose leaders called it fraud, rat poison, and a tulip mania.

If you’re fully onchain, you can hate that or front-run it — but you can’t ignore it.

Crypto as a technology stack is still native, permissionless and global.

Crypto as an asset class has been wrapped, securitized and indexed by TradFi, sold to the masses, and plugged into the same fee machines that run the rest of global markets.

The irony writes itself:

- The people who said Bitcoin would end badly

- Now make the most money from the fact that it didn’t.

Worth Checking Out.