With more than a decade and a half most of what crypto has achieved is to improve on existing services, creating new intermediaries that are more efficient, and in certain areas actually pioneered novel ways of building a product or launching a service.

Like every other venture, funding is required and a mechanism to raise capital is to be established. That was 2015-2017, the launch of the ICO(initial Coin offering) with no venture funding.

Just with a whitepaper and a website, you could raise millions of dollars from all over the world. With no KYC/AML, you were voluntarily contributing into a honeypot with no guardrails implemented.

It was novel as it provided an alternative funding model, but ended as a catastrophic disaster. Here are some stats:

- Failure Rate: Approximately 59% of projects launched in 2017 either failed or disappeared.

- Fraud: A high-level analysis identified around 78% of the ICOs as outright scams.

Product Development: Only 29% had developed a working product one year later, and a mere 8% successfully listed on exchanges.

According to Business Insider, $5 – 7 billion was raised.

This is not to say nothing good came out of this experiment since 2015 as the likes of Ethereum, Cardona, Ripple, Tron, BNB etc have grown to become huge successes.

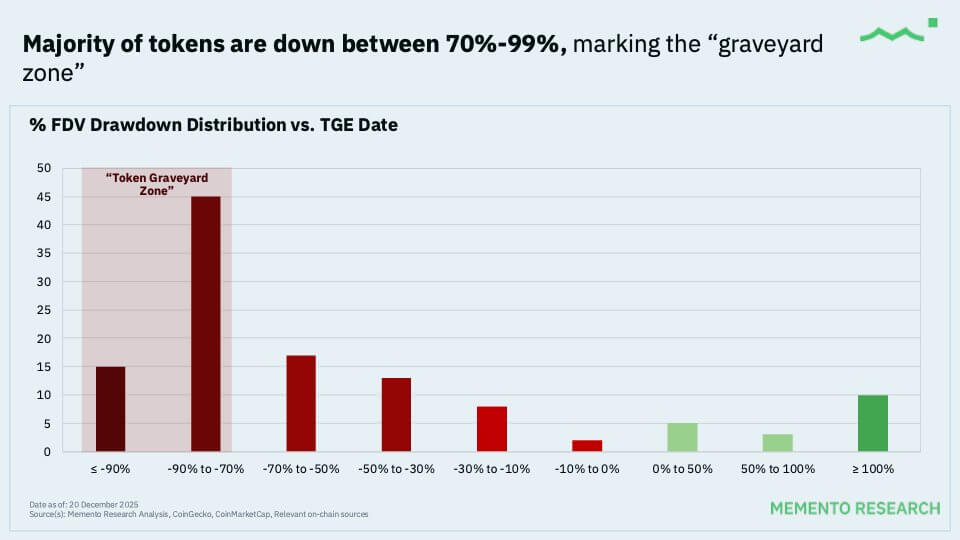

Fast forward to 2024-2025, a new phenomenon was noticed with VC – Backed tokens known as low float – high FDV i.e. tokens launched with a small circulating supply(low float) but have a high fully diluted valuation(FDV). At these high valuations, retail was basically exit liquidity for both VCs and insiders. Data on vested tokens was not trustworthy as it was found to be trading in phantom markets.

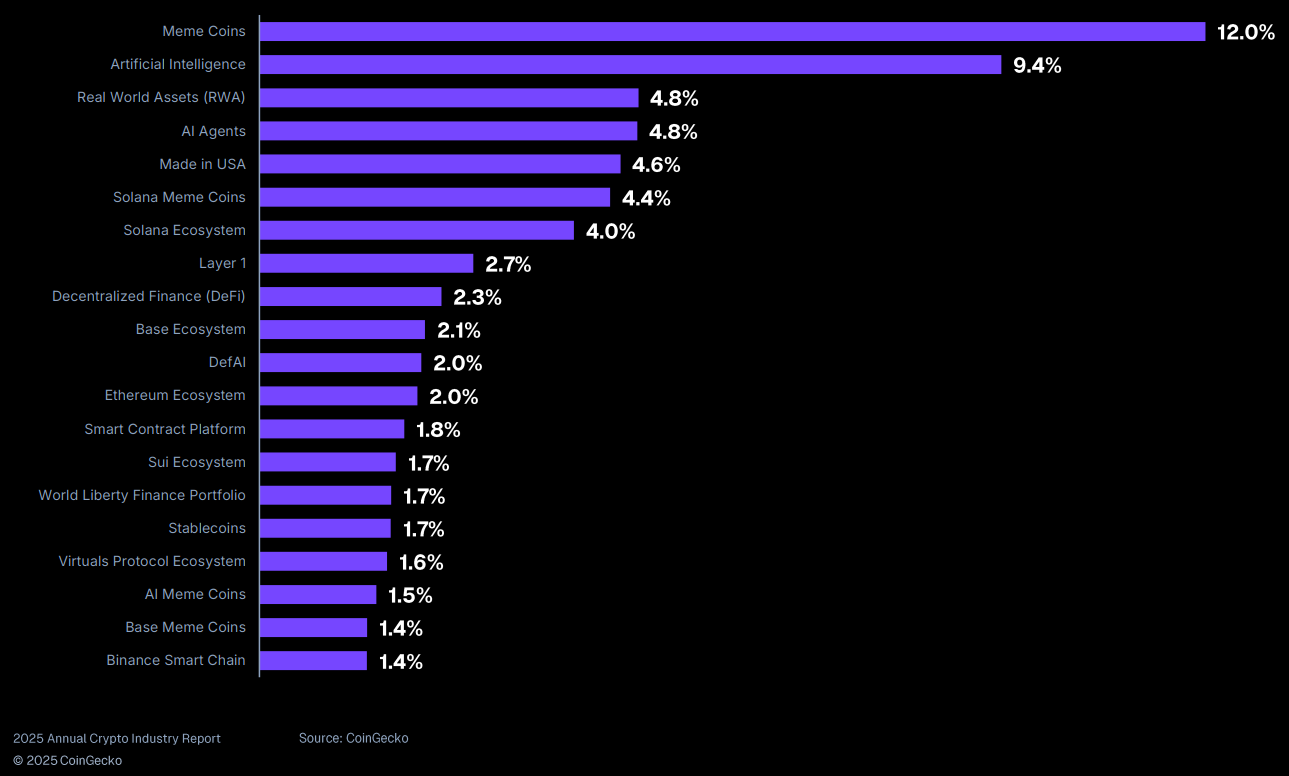

This is part of the reasons why Memecoins and AI Agents were among the top performing categories of 2025, in case you were wondering.

The data shows that more than 80% of token launches are under water, not because of bad market conditions but due to the extractive nature of token backers after listing.

Analytical Problems with the Current Model:

- Retail Disadvantage: Over 80% of token launches are reportedly “under water” (trading below their implied valuation), driven less by market conditions and more by the extractive tokenomics implemented by backers post-listing.

- Liquidity and Valuation: High FDV with low circulating supply creates an artificially high initial valuation, which often fails to align with sustainable market-driven value.

- Unanswered Questions: Key structural issues for longevity and community health remain unaddressed:

- User retention post-incentives.

- Building a community of “true believers.”

- Ensuring value accrues to actual token holders.

- Mitigating the risk of “rug pulls.”

These are pertinent questions and one of the projects addressing this is METADAO($META).

What is MetaDao?

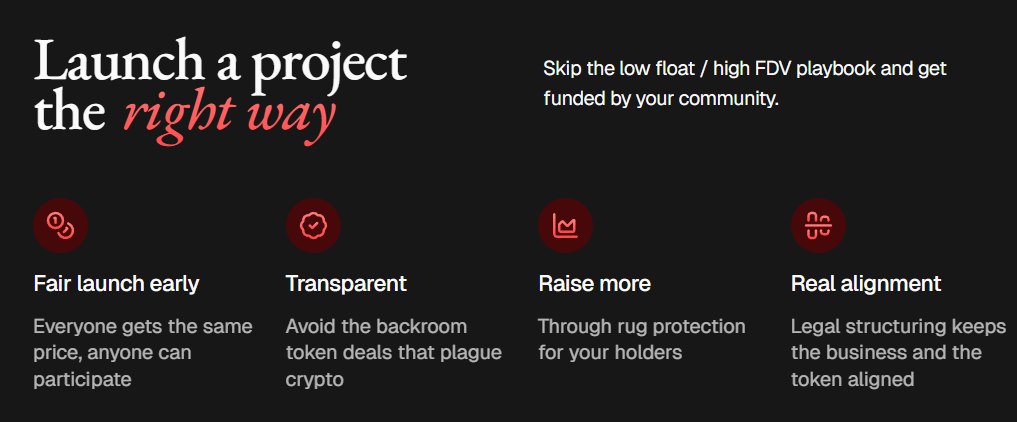

It’s a fundraising and governance platform founded on the principles of transparency and community participation. If truly as a founder who wants value to transfer to token holders that are locked in on seeing the success of your project, then Metadao is the place to both raise and launch your token.

How it works

Ideas are published.

Minimum fund raising goals set.

Community allocate into promising ideas.

Tokens distributed to subscribersrepresenting their stake.

Monthly operational budget set that will be needed from the treasury.

If the goal is not achieved then funds are returned to investors. Once successful the project is transferred to the management of the DAO(Decentralized Autonomous Organizations).

This is what has been described as a decision making market based on the principle of “futarchy” – Vote on values, Bet on Beliefs.

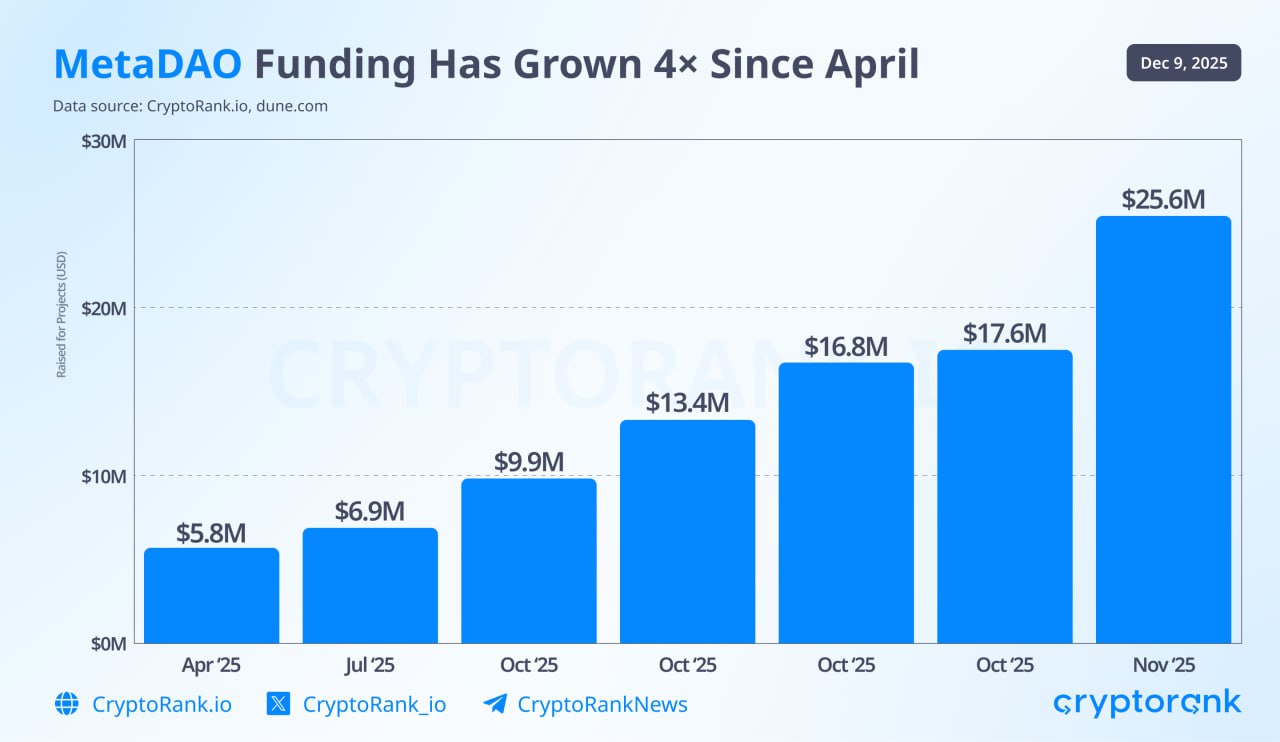

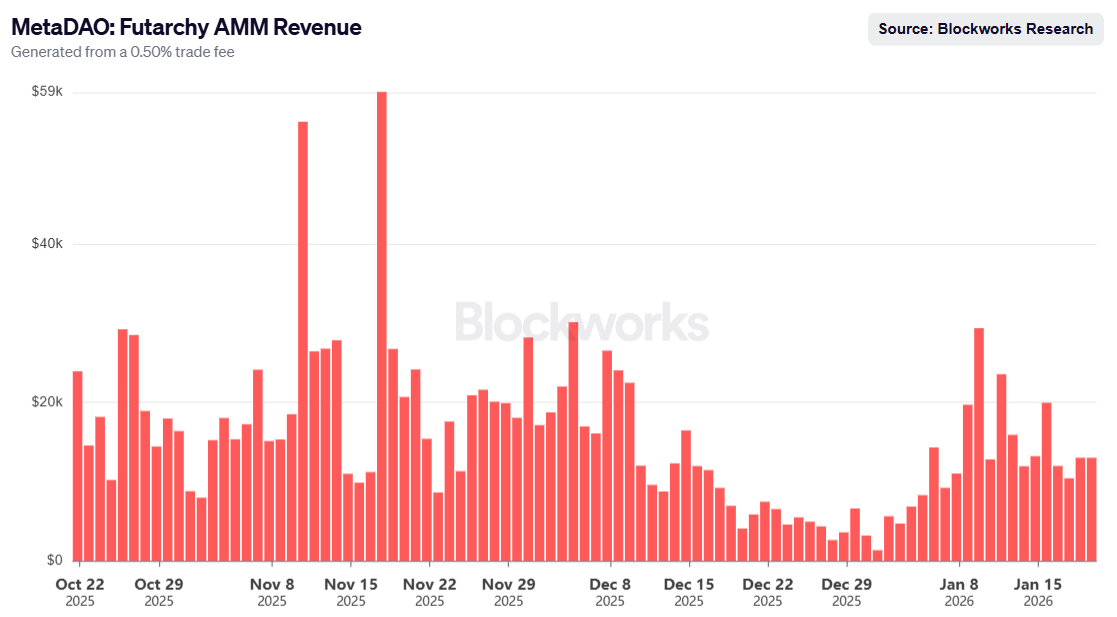

Users trade the outcome of management decisions and the price of MetaDao token has been holding strong even with the liquidation events of 10/10 where close to $19 billion was wiped off the market. Funding grew 4x since April of 2025.

This process of funding provides fair opportunity, community ownership, “unruggable” projects and a transparent decision making system.

Price action wise the MetaDao token($META) has held up pretty well compared to the rest of the market considering the bear case of the market.

This remains one of the most bullish projects within the solana ecosystem pioneering the internet capital meta as a result of its novel governance mechanisms that have completely disrupted traditional decentralized autonomous organizations as voters and their decisions really matter in the futarchy system.

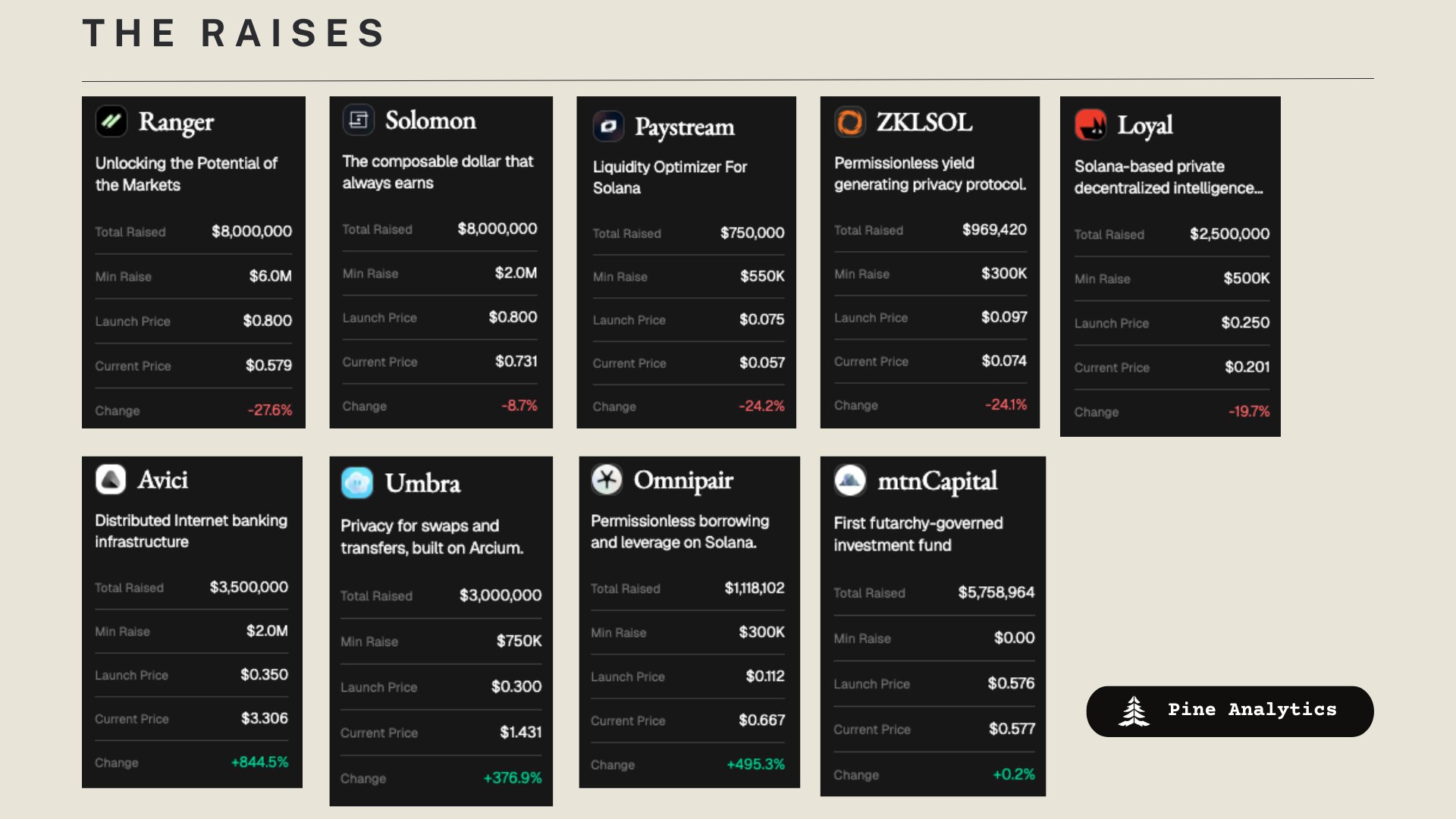

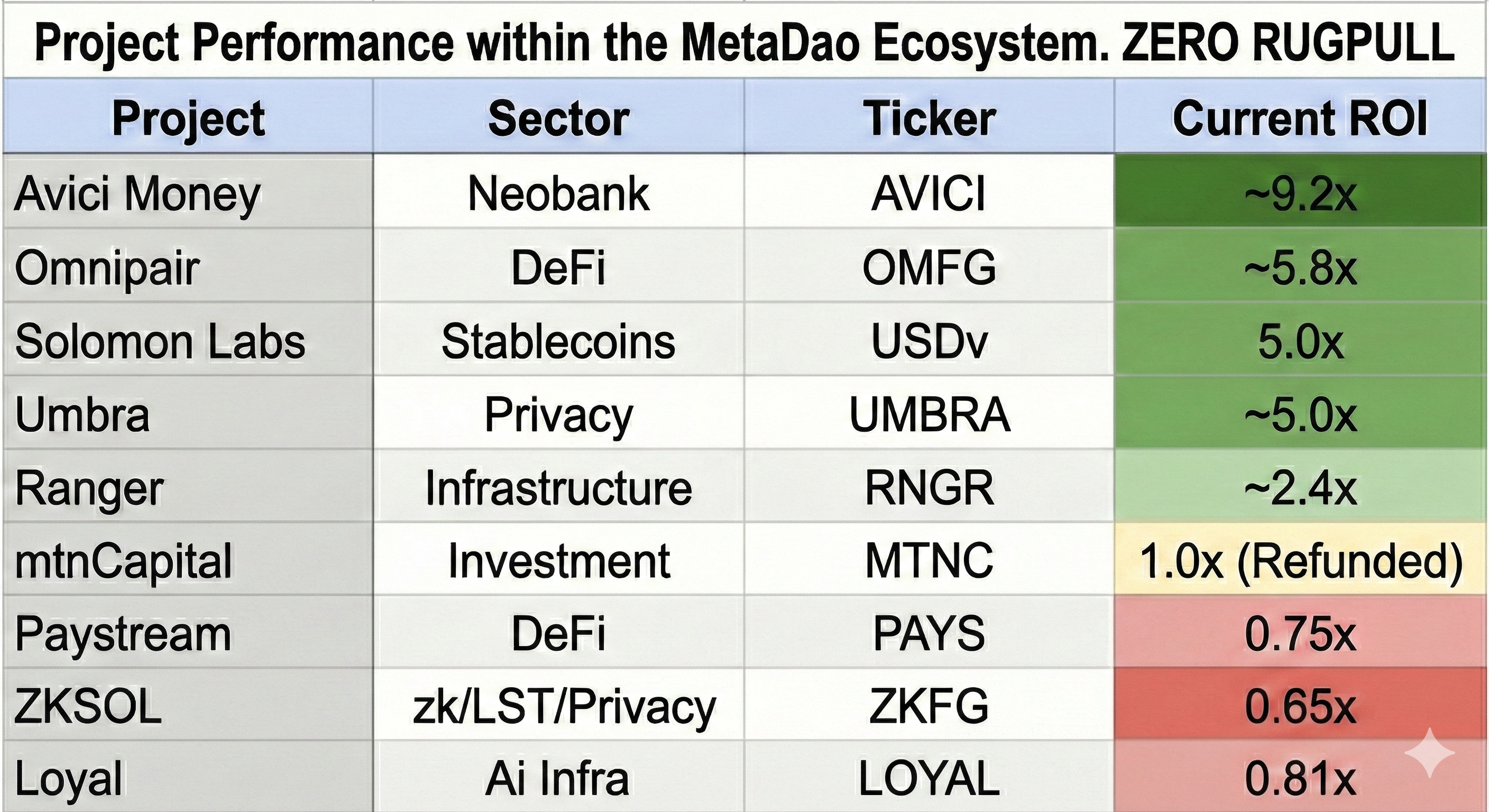

Institutions are noticing – the latest $9.9M OTC round was bought by funds like Variant, 6MV, and Paradigm. Projects that were raised on MetaDao have been amongst the best performers in the market and fall under the following categories: ICMs, Lending, Privacy,Dexes, Yield Farming.

Let the data tell the stories:

9 projects have raised through Metadao

Performance of projects since October

Revenue generated by Metadao

By focusing on community ownership, fair funding opportunities, and a transparent, decision-making system, MetaDao is positioning itself to be a leading project in the “Internet Capital Market” meta, seeking to drive value-oriented and revenue-generating growth on Solana.

Solana is seeking growth that is not memecoin driven and very few projects that are not just copycats or spinoffs are actually delivering that. We believe the next wave of crypto investors are seeking value-oriented and revenue generating projects with real cash flow.

Solana is the On-chain NASDAG and METADAO is a beta play.