For most of the internet, information moves constantly across the world in seconds, but money doesn’t really.

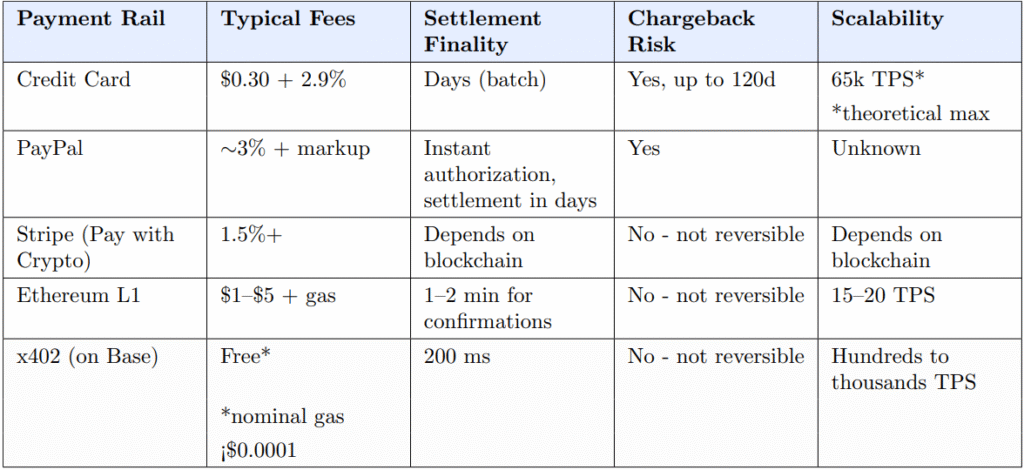

We can send a video across the world in seconds, but paying $0.25 to read an article or $0.05 to call a resource like an API is still weirdly hard. Cards, PayPal, Stripe, invoices, country restrictions, random errors, T + 3–5 day settlements are all layered on top of the web that was never built with money in mind.

x402 is an attempt to fix that at the internet layer itself.(Caveat: This is not a crypto native protocol, but an internet native HTTP State Protocol.)

Instead of “crypto as a new casino,” think of x402 as a native pay button for the web – something websites, apps, AI agents, and businesses can use to accept small payments instantly, with almost no friction.

In this article, I’ll break down what that actually means for:

- Everyday internet users (consumers)

- Small businesses, creators, and app builders

The goal is to show you where the rubber meets the road and future possibilities should this gain mass adoption. If you desire technicalities, see ref links at the end.

What Is x402?

When the web’s core protocol (HTTP) was designed, engineers left a status code unused:

HTTP 402 – “Payment Required”

Most are familiar with HTTP Status codes like 404(Not Found),403(Forbidden) etc.

The idea was: “One day the internet might need native payments.” That day never came – until now.

x402 is a new open standard that finally uses that 402 slot for what it was meant for: payments.

Here’s the simplest way to picture it:

x402 turns any website or API or digital service into a digital vending machine.

You ask for something → the site says “this costs X” → you pay → you instantly get access.

Under the hood, payments are done using stablecoins (crypto dollars like USDC) on fast blockchains. But as a user or business owner, what matters is:

- No forms, no logins, no card numbers.

- No Stripe/PayPal accounts to manage.

- Just: “Pay → unlock”, in seconds, over the internet.

Why Consumers Should Care (Even If You Don’t Care About Crypto)

If x402 gains adoption, here are the kinds of experiences it unlocks for normal users.

1. Pay per use instead of endless subscriptions

Today everything is a subscription:

- You subscribe for a whole month just to read one article.

- You pay for a full AI plan when you only need a few calls.

- You subscribe to a SaaS tool for one feature you use twice.

- You are on vacation and still getting charged for services you do not use.

With x402, services can be charged per article, per video, per AI call, per report – tiny, automatic payments instead of forced bundles.

You could imagine:

- Paying $0.10 to unlock one newsletter post.

- Paying $0.03 to generate a single AI image.

- Paying $0.25 to export a one-off CSV from a data tool.

These are all micropayments that current workaround solutions cannot provide as they already charge from 1-3% processing fee.

No account creation. No “Start Free Trial.” Just a one-tap payment from a wallet you control.

2. Global by default

Cards and banks are tied to countries, regulations, and intermediaries.

x402 is built around on-chain stablecoins, which are basically dollars that live on the internet. That means:

- A user in Nigeria, Brazil, or Europe sees the same price.

- The business doesn’t need separate local payment providers.

- Money moves in seconds across borders, not days.

If you’ve ever had a card randomly declined on a foreign website or cards declined when you travel abroad “for your security,” you already know how broken this is today

- Less oversharing of personal data

To pay with a card online you usually hand over:

- Name, Email, Card number, CVV, Billing address.

All this blindly trusting your information is truly “protected” and will not be sold to data brokers which is highly unlikely.

x402 doesn’t need any of that. Payments move from wallet → app, recorded on-chain. The site doesn’t have to store your card, your address, or your identity for a $0.30 transaction.

For small purchases and digital goods, that’s a big privacy upgrade.

- Chain – Agnostic

Like earlier mentioned, this isn’t a crypto native, but an internet native protocol revived by Coinbase and CloudFlare. It’s completely open-source and belongs to the HTTP Code States.

All you need to know about blockchains for transactions to happen is completely abstracted so you have a full web2-like payment experience just like from your normal bank account.

Why Small Businesses & Creators Should Care

If you’re a solo builder, SaaS founder, or content creator, x402 is less about buzzwords and more about business models.

1. Instant settlement, fewer middlemen

Traditional rails:

- 2–3% fee + $0.30 per transaction

- Chargebacks and disputes

- Payout in days

NB: You do not have to completely disregard traditional payment rails as they offer a sense of trust, reliability and protection when disputes arise.

x402 as a protocol has no protocol fee(there is an infrastructure fee which is now currently being absorbed by facilitators to bootstrap the cold start), and stablecoin transfers settle in seconds globally.

For very small payments (micropayments), that’s the difference between “not viable” and “suddenly possible.”

2. Granular pricing: sell tiny slices of value

With x402, you can finally price things in ways that have not been possible before:

- $0.05 per API call

- $0.10 per AI query

- $0.50 to export a report

- $1 to temporarily boost rate limits for an hour

Instead of forcing every customer into an $X/month plan, you can:

- Let casual users pay per use.

- Let power users still take a subscription if they prefer.

- Experiment with new models without rewriting your billing stack every time.

3. Machines & agents can pay you directly

This is where it gets futuristic, but it matters as software is no longer a tool but a potential client.

x402 is being positioned not just for humans in browsers, but for:

- AI agents buying data, tools, or compute.

- Apps paying each other for services on demand

- Machine-to-machine payments with no manual approval each time

If an AI agent can:

- Discover your service

- See the price in a standard way

- Pay you per call automatically using x402

…you’ve unlocked an entirely new customer class: software as a customer.

NB: Website building has to take into consideration that AI Agents will eventually have to Discover-See-Pay for services on their sites.

How x402 Works in 60 Seconds

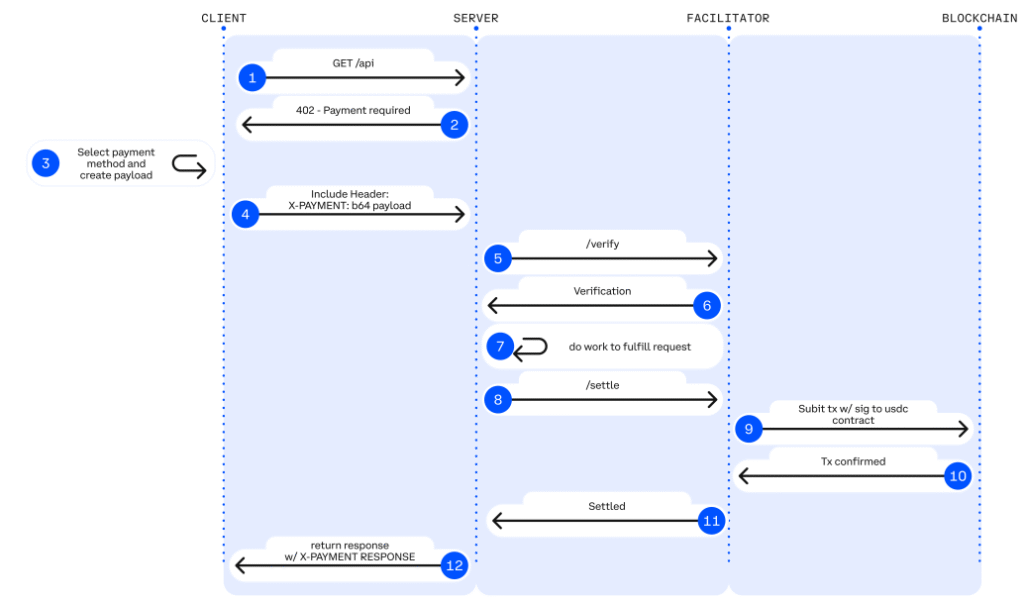

Here’s the basic flow when a user tries to access a paid resource:

- You request something

- e.g., an article, an AI endpoint, or a dataset.

- The server replies with “402 – Payment Required”

- Instead of just denying you, it includes:

- How much it costs

- Where to send payment

- What exactly you’re paying for

- Instead of just denying you, it includes:

- Your wallet/app pays using stablecoins

- It sends a small on-chain transaction through a facilitator (like Coinbase’s infrastructure) that can’t move your funds beyond what you authorize.

- The server verifies payment and unlocks the resource

- Once it sees the confirmed payment, it responds with “200 OK” and gives you what you asked for.

To you as a user, this can look like:

“Unlock this for $0.15” → tap → content appears.

No separate login. No typing card numbers. No monthly commitment.

Is This Just “Crypto Payments” Rebranded?

Fair question.

Here’s what makes x402 different from a random “Pay with Crypto” button:

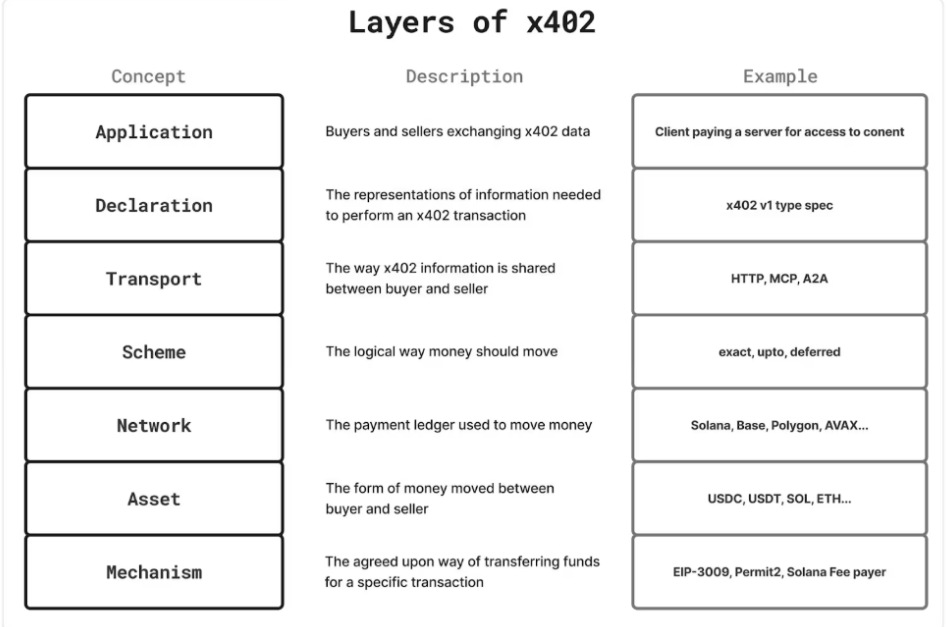

- Built into HTTP

It uses a status code the web already understands (402), instead of inventing a separate payment API. - Open & chain-agnostic

It’s a public standard, not a private company’s API. Different wallets, platforms, and chains can all speak x402. - Optimized for machines, not just humans

It’s designed so software and AI agents can understand pricing and pay autonomously. - Stablecoin-first

It focuses on dollar-like assets (e.g., USDC on fast networks) instead of volatile coins that swing 20% in a day.

So yes, it uses crypto rails – but the goal isn’t speculation. It’s making paying on the web as native as sending an HTTP request.

What’s the Catch?

We’re still early. Some honest constraints:

- You still need a wallet and stablecoins

For non-crypto users, that’s an extra step… for now. - Regulation and tax rules are still evolving

Businesses will need guidance on accounting, compliance, and treasury if they start accepting stablecoins at scale. - UX needs polishing

For this to hit mainstream, paying with x402 has to feel as simple as Apple Pay – ideally simpler.

This is being considered and worked about as we see in the x402 V2 depicting the various layers with suggestions for the protocol to be cleaner, more interoperable, and more future-proof, while preserving everything that made V1 successful.

The good news: big players like Coinbase and Cloudflare are backing this, and an ecosystem of tools, docs, and integrations is already forming around x402.

What This Means for You

If you’re a consumer, x402 is a glimpse of an internet where:

- You pay only for what you use

- You don’t have to give every site your card details

- You can access services globally without banking setbacks

If you’re a small business, creator, or builder, x402 is:

- A way to monetize APIs, content, and tools in much smaller increments

- A path to reach global users (and AI agents) with less friction and fewer middlemen

- A chance to experiment with entirely new business models around micropayments and machine-native commerce

This isn’t just about “crypto.” It’s about finally turning the web’s forgotten “402 – Payment Required” slot into a real payment layer – one that normal people can actually benefit from.

The current financial system is one giant complex reconciliation web as they all talk to each other but siloed. But, x402 just turned the internet into one giant global vending machine.

It might sound dystopian and futuristic, but not according to MeritSystems whose mission is to build the : The financial stack for open-source software(payment engine for GitHub).

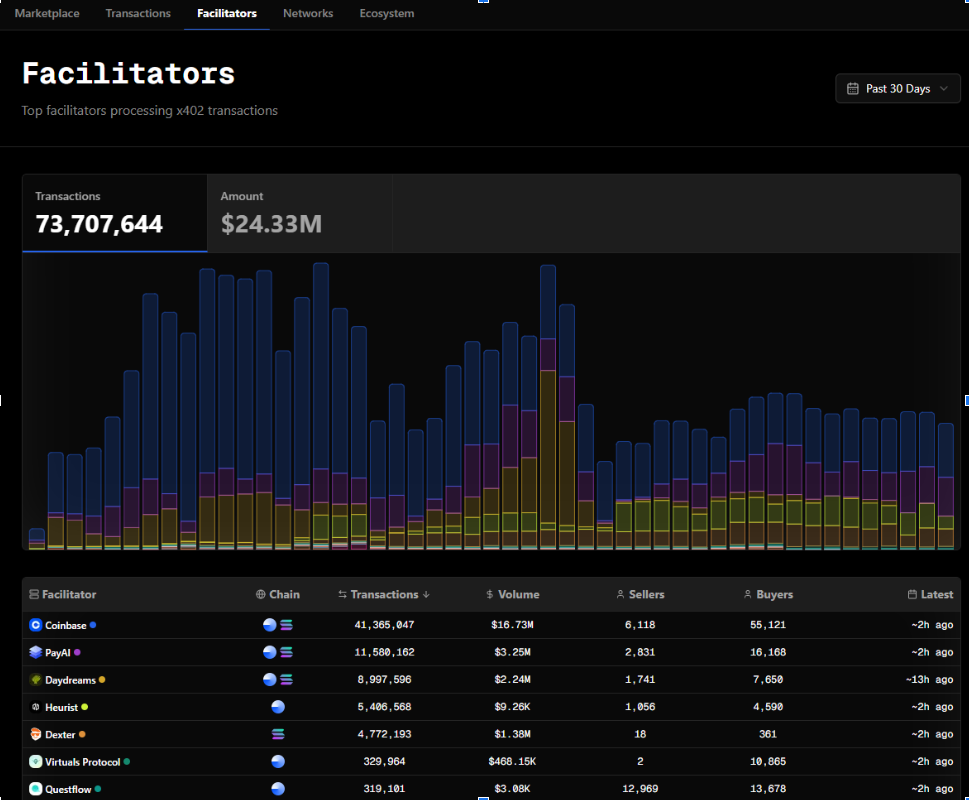

They offer visibility to the ecosystem through the x402scan dashboard to track resources utilized, transaction volumes and also give you an opportunity to spin your own agent that uses x402.

Conclusion

The future of commerce and digital payments does not require more complex reconciliation systems, but payment services with costs and flexibility that do not eat into client margins.

X402 is here and working within the software as a client niche for now, Coinbase has made it open source and chain-agnostic, but most of the transactions are facilitated by its facilitator(risk is centralized).

Privacy, compliance and regulations still have to be baked into its implementation for it to hit critical mass.

Complain about payment giants all you want, truth is they work and are reliable. Until we get the right infrastructure that gives them the sense of trust required, we are still a long shot away.

The mission of x402 remains the same: Enable value to move across the internet as seamlessly as information, whether the actor is a human, an app, or an agent.

Goodnews: It’s open source and may just become the Linux of Payments.

References:

Google Agent Payment Protocol(AP2)

Worth Checking Out.